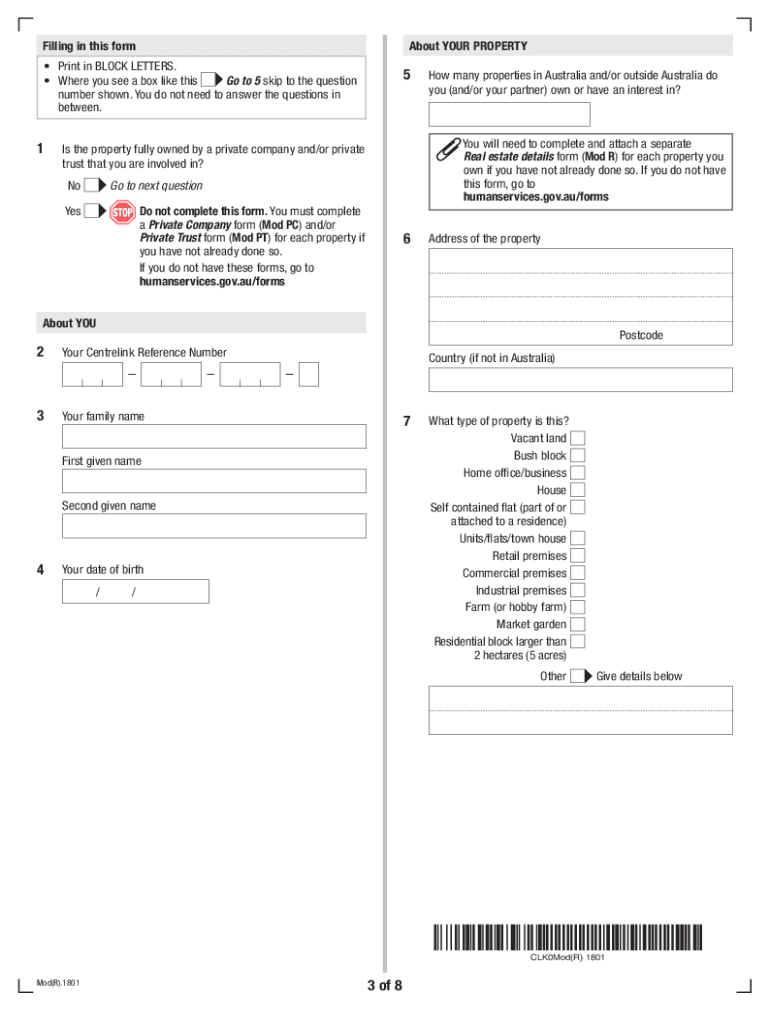

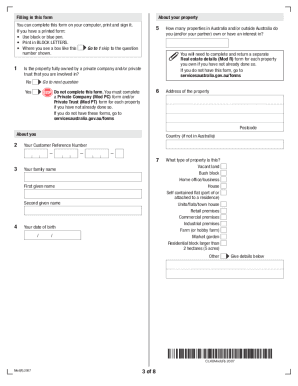

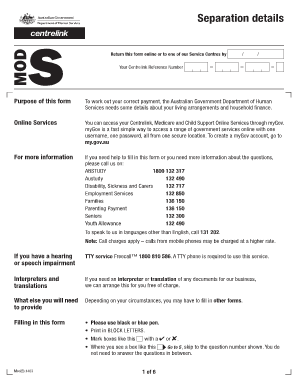

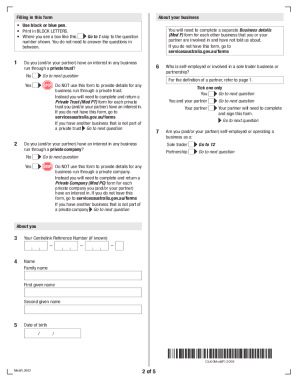

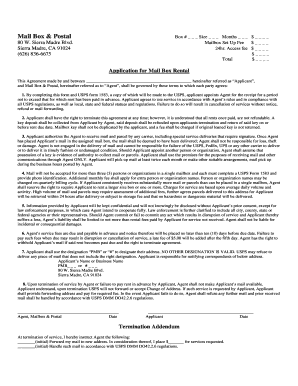

AU Mod(R) 2018 free printable template

Get, Create, Make and Sign AU ModR

How to edit AU ModR online

AU Mod(R) Form Versions

How to fill out AU ModR

How to fill out AU Mod(R)

Who needs AU Mod(R)?

Instructions and Help about AU ModR

Hi welcome to another video in my series on complain numbers and in this particular video what we're going to look at is the modulus argument form of a complex number now suppose I take a complex number Z equals X plus in we've already seen that the argument of Z or Are head for short is the Angle made between the positive real axis and the complex number said so in this example it would be this angle theta here and remember that theta is normally measured in radians, and it is always greater than minus PI radians but less than or equal to PI radians, so we've got argument theta the other thing is that the length of this line here given by the complex number said we know is called the mod the or modulus of Z, and I'm going to call it R so if we just have a look at completing a triangle through here then we've got a right angle triangle something like this and let's say that this distance across here well that's going to be X and this vertical distance here is going to be Y so by basic trigonometry we should know that the cosine or cos for short of the angle theta compares the adjacent side to the hypotenuse x over R in other words and if we rearrange this to make X the subject X will equal R cos theta if we do a similar thing to get Y we see that sine of the angle theta equals the opposite side Y over the hypotenuse R, so it follows from this statement that y equals R sine theta now that means that our complex number Z can be written as X plus in well we know that X is R cos theta, and then we've got plus in which will be I time R sine theta I R sine theta, and we can pull out R is a common factor here, and so we get that Z equals R, and then we've got bracket because theta plus I sine theta, and it's this format here that is often referred to as the modulus argument form now this is going to work wherever Zed is whatever quadrant Zed is in okay as long as we remember to make sure that theta lies in this particular range now let's just try a few examples, so I can show you how this is going to work I've got here express the following in modern form got four examples here I'm going to show you how to do number one here to express the complex number 3 minus 2i, and I'll leave you to have a go at two three and four all right, and then we'll work through the work solutions you might even want to have a go at this one now okay just pause the video and come back when ready okay well let's just see if you did have a go at this how you got on so let's just say that Z equals that let's say lets said okay equal 3 minus 2i so the first thing I would want to do is draw a sketch for this complex number on an Armand diagram, so we've got our real axis here, and we've got our imaginary axis up here so for Z being 3 minus 2i that's going to be a complex number where we go three units that way two units down, so it's going to be something say like that okay, so that's Zed we know that if we were to complete this triangle in here this would be three units and...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get AU ModR?

How do I make edits in AU ModR without leaving Chrome?

How do I complete AU ModR on an Android device?

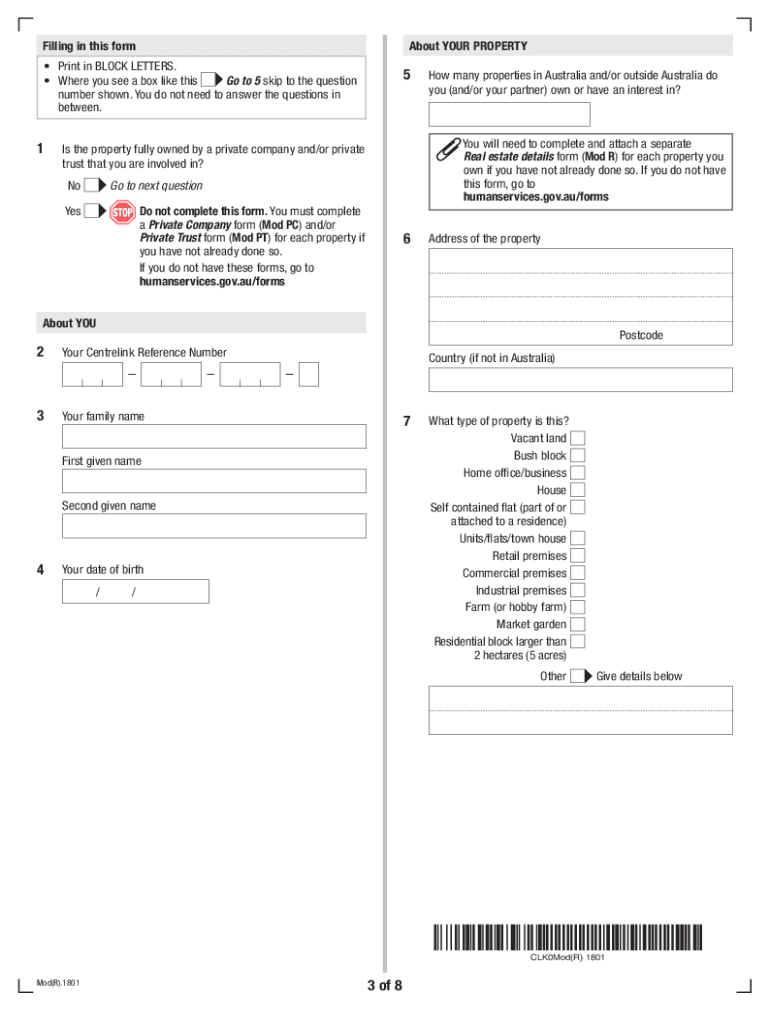

What is AU Mod(R)?

Who is required to file AU Mod(R)?

How to fill out AU Mod(R)?

What is the purpose of AU Mod(R)?

What information must be reported on AU Mod(R)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.